Spectra Logic Rides the Data Explosion Wave with Tape

If you listen to the quarterly conference calls of the big IT suppliers who play in the tape market, as we at EnterpriseTech do, invariably you hear them bemoan the fact that their tape storage businesses are on the decline. Tape library supplier Spectra Logic is bucking this trend, and it is doing so by listening very carefully to its customers.

To make that point at the Forever Data 2013 summit that Spectra hosted in Denver, Colorado this week, founder and CEO Nathan Thompson gave out some financial figures about the privately held company.

Spectra doesn't just sell tape libraries. It also is a reseller of the tape cartridges that populate the libraries, and interestingly it gives a lifetime warranty for those cartridges. This allows Spectra to command a premium for the media it supplies to customers while also providing a service for that premium. The company does not make its own tape drives – it resells LTO and TS1140 tape drives manufactured by IBM – but it does design and make its own libraries as well as creating the software to manage the storage devices. In fact, says Thompson, about 80 percent of the developers who work at Spectra are creating software, not designing hardware.

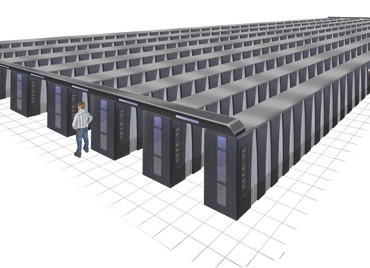

That said, the hardware is impressive. During a tour this week at Spectra headquarters outside of Denver, which was a hotbed of disk and tape storage for many decades, Thompson showed off the top-of-the-line T-Finity tape library, which is a complete beast:

The T-Finity frame can hold a maximum of 24 tape drives, with multiple robots to keep them fed. Each frame has 920 tape cartridge slots. The library scales up to 40 frames with a maximum of 120 drives, for a total capacity of 50,100 cartridges for a maximum capacity of 125 PB of uncompressed data and something on the order of 313 PB assuming the 2.5 to 1 compression ratio for LTO-6 drives. (LTO-5 gives something around 2 to 1 compression for data that can be compressed, and the TS1140 is closer to 3 to 1. Video data, for instance, cannot be compressed.) It takes anywhere from 20 to 80 seconds to get a tape from a shelf, depending on where it is in relation to the two robots inside the enclosure, and another minute and a half or so for the tape cartridge to be mounted and start searching for data. But once the data is located, it can stream out of the tape at a sustained data rate that is as good or better than any disk drive can do.

Thompson told EnterpriseTech that a 40-frame T-Finity would cost somewhere between $800,000 and $1 million at list price, and depending on the drive and media types used, a fully loaded machine with 120 drives and all of its media bays full would have a list price of between $4 million and $6 million.

If that is not big enough for you, then Spectra can make what it calls a T-Finity library complex, which hooks together eight of the T-Finity frames to create a truly immense storage device with 16 robots, 320 frames, and capable of storing 3.6 EB (that's exabytes) of capacity using TS1140 drives. With a full complement of 960 drives, this library complex can sustain 2.2 PB per hour of bandwidth into or out of the drives.

No one has bought such a behemoth tape library yet, but Spectra chief marketing officer Molly Rector said at the conference that the company has sold exabyte-capable systems into single organizations already. (That doesn't mean they have the full cartridge capacity in these machines.) General IT customers and companies in the media and entertainment sector tend to drive higher volumes of smaller products for Spectra, Rector explained. The HPC market accounts for about 18 percent of the company's business, and the media and entertainment sector something in the high 20 percent range, she said. One or two big Top 10-class HPC systems are installed each year with Spectra libraries, and the oil and gas industry is a big fan as well. The company also sells lots of libraries into state and Federal government organizations. The finance and banking industries tend to go with tape solutions from IBM and Hewlett-Packard, who are their system and disk storage suppliers, too.

The interesting bit about Spectra, which has been around since 1979 and which has grown to have just under 400 employees, is that it has managed to keep growing in a market that has been under intense pressure. Thompson showed off his revenue growth since 1999 in his opening keynote for the conference:

The company's fiscal 2013 year ended on June 30, and Thompson revenues were up 16 percent year-on-year across all product lines. The company shipped 1.2 EB of tape library storage capacity in the fiscal year. Tape media sales were up 24 percent, services revenues were up 16 percent, and revenues for enterprise tape libraries (those with more than 100 slots) were up 14 percent. Small library revenues rose only 6 percent in the twelve month period, and midrange libraries saw 12 percent growth. Spectra did not give out precise revenues, but Thompson said that the company had "9 digits of revenue." That's hundreds of millions of dollars, and growing more or less steadily. The T950 libraries, launched in 2004, have by themselves generated more than $250 million in revenues, Thompson said.

One of the drivers of that revenue growth for Spectra is its continued investment in research and development, explained Thompson, and he showed off the share of annual sales that gets allocated to R&D and how it correlates with product launches. Some of which did not do well, like the RXT removable disk array, but which laid the groundwork for future products.

"This is about twice what the big guys do," Thompson said about the R&D investment rate at Spectra relative to IBM, HP, Oracle, and Quantum. "And luckily we are profitable and can afford to do this."

One of the things that Spectra continues to invest in is disk-based archiving solutions, and its latest, called the nTier Verde, was soft-launched back in April 2013. The company didn't even put out a press release for it, and was waiting until its complete DS3 object storage announcement and the BlackPearl appliance that makes use of this object storage protocol was made at the Forever Data 2013 summit to even talk about it.

The nTier Verde is the fourth generation of disk-based archiving systems to come out of Spectra, and a rack of the machine has a master node with from 10 to 35 disk drives and nine expansion nodes with 44 disks each. It scales from 40 TB to 1.7 PB of raw, uncompressed archiving capacity.

The idea behind the nTier Verde, explained Rector, was to give customers NAS-based disk archiving at a block storage price. Rector said in her presentation on the new product that a typical NAS array with 1.4 PB of uncompressed capacity costs something on the order of $1 to $3 per GB, depending on the features in the array. The nTier Verde is priced at around 45 cents per GB, and will eventually be able to talk to the BlackPearl appliance to be able to shove object stores out to the T-Series tape libraries.

But still, you can't beat tape to get the cost down. If you want to store 1.9 PB of data in a T380 library with LTO drives and have a BlackPearl appliance on the front end, this will cost around 14 cents per GB. If you move up to the T950 library and use LTO drives for 2.4 PB of capacity, you drop down to 10 cents per GB. And if you switch to TS1140 drives, you can get 6.4 PB of capacity in the same T950 array and do it for 9 cents per GB.

By comparison, the disk-based Glacier storage service from Amazon Web Services costs 1 cent per GB per month. If you can compress your data and work down the list price of the library and media a bit with Spectra, you can easily beat the AWS price for Glacier. And you don't get hit with the data transfer fees that AWS slaps on top of the storage fees.

This is another reason why Spectra still has a growing and profitable business. It also explains why AWS made the Glacier service tape-capable even if it is not using tape just yet.