With Cloud and Mobile, Moven Brings Banking into Digital Age

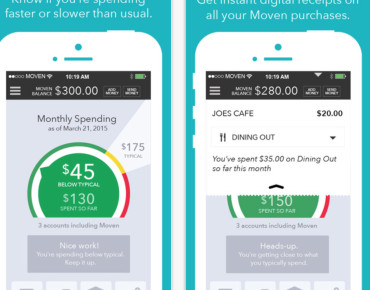

Moven iPhone app

Without cloud or mobile applications, startup financial firm Moven might not exist. After all, the digital-age company is using these assets to both compete and ally with traditional banks.

The four-year-old company, which had a soft launch in 2013, provides users with a free Apple or Android app that tracks their debit card purchases in real time. Backed by Kansas-based FDIC member CBW Bank, Moven provides customers with fee-less Moven accounts that come with their own debit card. By using the debit card, customers gain insight into – and hopefully control over – their spending habits, said Bob Savino, chief technology officer of Moven, in an interview.

"Our biggest feature set is the ability to understand your financial situation when you're on the move. As soon as you swipe your debit card, we immediately run your debit card. We run analytics," he said. "We also tell you how you're spending – red, yellow green – with a goal of actually changing people's financial behavior. This is like a digital checkbook. It is an extraordinarily powerful idea."

Moven both competes with and complements traditional banks, said Savino. In fact, Moven uses many well-established banks' conservative fear of newer technologies like cloud to create a market for its services, he said. By shunning the traditional datacenter, Moven eliminates traditional costs -- both technology and staff -- and can pour its resources into innovation, sales, and marketing.

"We're not just disrupting banking, we're disrupting banking products," Savino said.

In addition to offering the smart debit service directly in the United States, Moven is partnering with international banks to bring this service to their customers, he said. The company currently has "15 in the pipeline and two set to go live," including Westpac bank, New Zealand, and TD Canada, said Savino.

But Moven is relying on its investment in cloud to propel the company's profits and reach to other international banks, too. When it first began, Moven chose Amazon because of its low cost of entry, Savino said. But when Moven designed a proprietary infrastructure – Moven Global Distributor (MGD) – as the basis of its second line of business, the company banked on Amazon again. In this other offering, Moven offers "de-risked innovation," he said, whereby Moven replicates its business for existing banks.

"At first, we just needed infrastructure as a service. That's how it started, but it was a good choice, a lucky choice if you will," said Savino. "We made a decision a year ago when we decided to do this global distribution model to stay with Amazon because they have the most innovative features, the most global reach. Every country we want to go in has an Amazon presence of some sort. We can innovate on top of Amazon. I like to call it 'planned vendor lock-in.'"

By partnering with Moven, banks use the Amazon-MGD infrastructure to more quickly launch new services, without the costs or time investments typically associated with new banking products, he said.

"They want the Moven start-up as a segmented model," he said. "We're integrating with existing systems from a core banking perspective, but deploying as an entirely new brand. If a big bank wanted to enter a new market without the public cloud it could cost tens of millions; for us it costs thousands of dollars."

Next up: Analytics.

"We're building a data team right now, data scientists. Amazon has all the tools we'll need for data," said Savino. "Even with our MGD, it's pretty novel to deploy; within two seconds we didn't only tell you what you spent but how that spending affects you over time."

Related

Managing editor of Enterprise Technology. I've been covering tech and business for many years, for publications such as InformationWeek, Baseline Magazine, and Florida Today. A native Brit and longtime Yankees fan, I live with my husband, daughter, and two cats on the Space Coast in Florida.