Nvidia Earnings Top Expectations, Data Center Revenue Jumps 80%

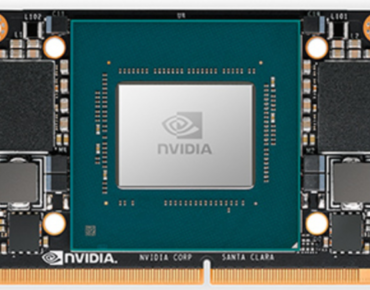

Nvidia EGX Jetson Xavier NX

Nvidia’s seemingly endless roll continued in the first quarter with the company announcing blockbuster earnings that exceeded Wall Street expectations. Nvidia said revenues for the period ended April 26 were up 39 percent YoY to $3.08 billion, ahead of its own forecast of between $2.94-$3.06 billion, which included a $100 million impact from the COVID-19 pandemic.

Net income was $917 billion, up 106 percent from Q1 2019. Earnings per share were $1.47, up 130 percent from a year ago.

The company’s stated mission of becoming a “data center scale computing company,” according to CEO Jensen Huang, was borne out with its record data center revenues of $1.14 billion, up 80 percent from a year earlier. The results do not include revenue from Mellanox, whose high performance network gear is expected to increase Nvidia’s data center presence. Mellanox entered into a $7 billion acquisition agreement with Nvidia last year that was completed in late April. Mellanox sales will be included on Nvidia’s balance sheet next quarter.

“The new Nvidia has a much larger footprint in data center computing, end-to-end and full-stack expertise in data center architectures and tremendous scale to accelerate innovation,” said Huang during an earnings conference call. “Nvidia Mellanox are a perfect combination and position us for the major forces shaping the IT industry today, data center scale computing and AI.”

“The new Nvidia has a much larger footprint in data center computing, end-to-end and full-stack expertise in data center architectures and tremendous scale to accelerate innovation,” said Huang during an earnings conference call. “Nvidia Mellanox are a perfect combination and position us for the major forces shaping the IT industry today, data center scale computing and AI.”

“Going forward, the new unit of computing is an entire data center,” Huang said. “The basic computing elements are now storage servers, CPU servers and GPU servers, and are composed and orchestrated by hyperscale applications that are serving millions of users simultaneously. Connecting these computing elements together is the high-performance Mellanox networking. This is the era of data center scale computing.”

The earnings report follows Nvidia’s launch last week of a slew of new products, including the A100 data center GPU, based on the company’s new Ampere architecture, which the major public cloud companies (AWS, Microsoft Azure, Google Cloud) are installing in their cloud platforms, according to Nvidia. The company also introduced the DGX A100, a 5-petaflops high performance system built for AI. The company also announced two GPU-based processors designed for edge AI workloads.

“Our data center business achieved a record and its first $1 billion quarter,” Huang said. “NVIDIA is well positioned to advance the most powerful technology forces of our time – cloud computing and AI.”

Looking ahead, the company said it expects the good times to continue, with revenue for the second quarter anticipated to be $3.65 billion, plus or minus 2 percent, with Mellanox contributing “a low-teens percentage” of combined second quarter revenue.