Nvidia Leads Booming Ethernet Adapter Market

Among the growing list of pandemic-driven technology segments are programable Ethernet adapters being deployed by cloud service providers as they scramble to meet bandwidth demand generated by homes offices.

The server and Ethernet adapter boom also have accelerated deployments of programmable network interface cards (NICs), with Nvidia’s former Mellanox unit alone posting a 96 percent gain in quarterly revenues compared to a year ago. Market tracker Omdia reports that Nvidia Networking’s (formerly Mellanox Technologies) adapter revenues during the first quarter of 2020—$136 million—were the highest quarterly revenues ever recorded by any Ethernet adaptor vendor.

The surge in datacenter server and Ethernet adapter deployments simultaneously boosted demand for programmable NICs, allowing cloud service providers to increase average revenue per port. Omdia said. Broadcom, Xilinx and Marvell Technology all reported brisk demand for 25-gigabit Ethernet network cards. Hence, 25 GbE cards account for an estimated 35 percent of datacenter Ethernet adapter ports.

“Offloading virtual network functions like virtual switching and encryption is appealing to [cloud providers] as it can free up CPU cores, enabling a higher number of virtual machines or containers per multi-tenant server,” said Omdia datacenter analyst Manoj Sukumaran. That configuration helps cloud providers boost per-server revenues, Sukumaran added.

Revenues from datacenter purchases of Ethernet adapter equipment are therefore forecast to grow 20 percent this year, with growth accelerating through 2024 via server shipments and adoption of higher-speed programmable adapters. Those leading-edge adapters can include FPGAs, systems-on-chip or other programmable processors, enabling so-called off-load adapters to handle on-card processing of network, memory and storage protocols.

Omdia forecasts the programable adapter market will generate revenues approaching $2.3 billion by 2024.

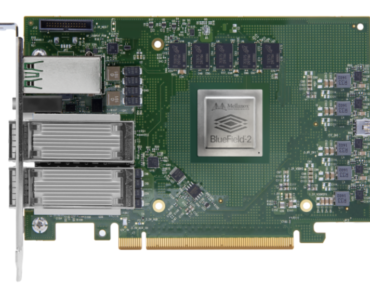

Nvidia’s Mellanox unit benefitted the most from datacenter and enterprise investment in programmable Ethernet gear, reflecting the uptake in 25- and 100 GbE offload adapters. Nvidia Networking recently shipped the industry’s first 200 GbE offload NICs.

Meanwhile, runner-up Intel Corp.’s Ethernet lineup includes NICs, but Omdia notes they do not offer full on-card processing of network, memory and storage protocols. Intel’s 800 adapter series announced last year has yet to ship, and “Intel is losing out because of the delay,” it noted.

Nvidia Networking’s unprecedented growth in Ethernet adapter technology and programmable NICs also illustrates how it continues to make inroads in enterprise datacenters, especially for growing connectivity requirements. Observers said that growth is likely coming at Intel’s expense.

With reports this week that Nvidia (NASDAQ: NVDA) is negotiating to acquire semiconductor IP specialist Arm, observers said Intel (NASDAQ: INTC) finds itself on the defensive. The chipmaker would “really like to thwart Nvidia’s drive into what Intel had thought was [its] domicile, the datacenter,” said industry analyst Jon Peddie.

Related

George Leopold has written about science and technology for more than 30 years, focusing on electronics and aerospace technology. He previously served as executive editor of Electronic Engineering Times. Leopold is the author of "Calculated Risk: The Supersonic Life and Times of Gus Grissom" (Purdue University Press, 2016).