Blockchain Network Filecoin Looks to Disrupt Cloud Storage

A blockchain-based effort expected to be launched next month is intended to do nothing less than decentralize and disrupt the highly-concentrated cloud storage market.

The Filecoin Network is promoted as bypassing incumbent cloud storage providers and their business model that involves bundling relatively cheap, scalable data storage with costly and proprietary software, application interfaces, servers and other infrastructure. “That means storage buyers can’t access storage directly and efficiently, but instead have to pay for a host of additional services and features,” proponents of the “Filecoin Economy” assert.

As the amount of data stored approaches hundreds of zettabytes, current Web 2.0 storage platforms continue to generate huge profits. Estimates of the size of the cloud storage market range from $46 billion to as much as $96 billion when including infrastructure, platform and hosted private cloud services.

Amazon Web Services, Microsoft Azure and Google Cloud along with Chinese cloud giants Alibaba and Tencent account for roughly two-thirds of the global cloud storage market, according to Synergy Research Group.

Filecoin, is the brainchild of Protocol Labs, a San Francisco-based networking operation with marque financial backers that include Andreessen Horowitz and Sequoia Capital. Filecoin, structured as a unit of Protocol Labs, has raised more than $258 million in venture funding, according to the website Crunchbase.com.

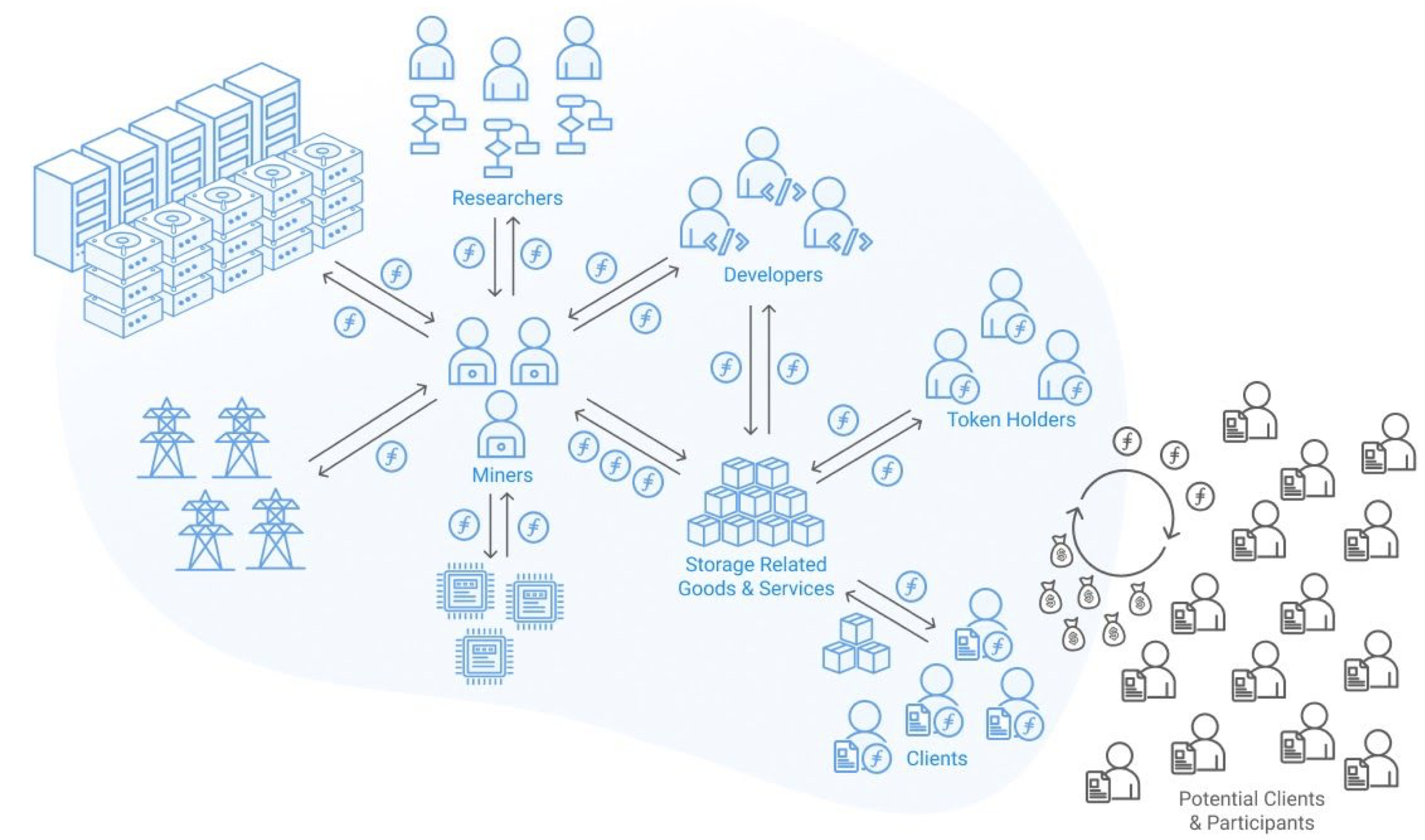

Filecoin’s disruptive mission is to use blockchain technology to allow users to negotiate directly with crypto-token “miners”. The blockchain framework allows consumers to identify and verify local storage facilities and negotiate prices over social media.

The decentralized model confronts the current approach where user data is hosted and stored in regional datacenters, usually at fixed rates.

Filecoin is being readied for launch next month as a blockchain protocol known as a “mainnet,” meaning it is entering production and cryptocurrency transactions are being broadcast over the network, verified and recorded on a distributed ledger. Fundamentally, the decentralized network aims to eliminate the “middleman,” in this case, large public cloud providers.

The Web 2.0 business model has fueled the enterprise shift toward multi-cloud deployments as companies seek to avoid vendor lock-in. Filecoin would take that strategy a decided step further by creating a decentralized storage network. Ahead of the mainnet launch, Filecoin said this week its protocol would support storage “sectors” up to 64 Gb for up to 18 months.

Blockchain storage is based on unused disk space scattered across the globe. Thus far, Filecoin said it has attracted more than 300 “miners” who must commit storage resources to participate in the blockchain-based economy. Those network participants spread over six continents so far account for more than 31 petabytes of storage.

The "Filecoin Economy" combines disks, algorithms, datacenters, processors, software and other resources that are converted into traded storage services.

Storage agreements between clients and Filecoin miners “could be proposed over digital spaces like Twitter or email—especially for storing large amounts of data,” Filecoin said in releasing a “crypto-economics” report this week.

“Many third-party entities operating on this platform can enhance the deal proposal and matching process, including participation from exchanges or the creation of novel aggregators of deal bids and asks,” it added.

As it prepares for production deployment of the blockchain protocol, reports have surfaced of tensions between parent company Protocol Labs and its investors. According to an Axios report, a “revolt” among equity investors is seeking a larger share of compensation in the form of Filecoin tokens. Filecoin raised more than $200 million in token sales during a 2017 offering.

The dispute has reportedly delayed the Filecon rollout. To rebuild momentum, the network released a report this week laying out its value proposition, highlighting open, “verifiable” storage options. “Distribution of storage empowers local optimization,” the report asserts, a reference to big data storage closer to users as opposed to relying on large regional datacenters.

“The Filecoin Economy should communicate information more efficiently, and the network will be more responsive than centralized storage platforms,” it added.

Related

George Leopold has written about science and technology for more than 30 years, focusing on electronics and aerospace technology. He previously served as executive editor of Electronic Engineering Times. Leopold is the author of "Calculated Risk: The Supersonic Life and Times of Gus Grissom" (Purdue University Press, 2016).