Industrial-Strength Private Wireless Nets Emerge

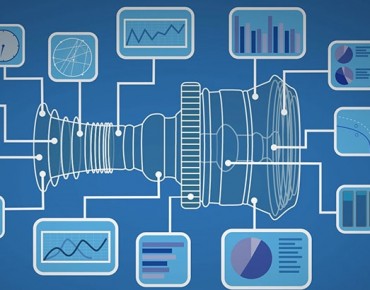

Network equipment makers are zeroing in on emerging 5G wireless capabilities increasingly seen as the backbone for industrial Internet of Things (IoT) deployments.

Those 5G equipment vendors are shifting their focus from consumer to enterprise applications as manufacturers implement 5G-based private wireless networks to support Industry 4.0 and other data-driven applications.

The next-generation factory floor “is full of technology,” said Mike Calabrese, Nokia Enterprise’s senior vice president for the Americas. “Thousands of sensors, massive amounts of raw data, AI-enabled manufacturing platforms—all of this happening in real time.”

Nokia (NYSE: NOK) and other equipment vendors note the unprecedented scale of industrial IoT deployments, creating requirements for differentiating between robot telemetry, for example, and the uploading real-time data to the cloud. In order to scale, Calabrese said, “These [technologies] are communicating openly and are operating holistically across the ecosystem” within next-generation manufacturing infrastructure.

For manufacturing, logistics and transportation, early deployments have begun, but most have yet to scale, the Nokia executive said. “In order to scale, they have to be powered by mission-critical networks with the right level of digital automation.”

Nokia launched its enterprise unit about two years ago as IoT deployments began to roll out, with a particular emphasis on mission critical networks and “asset-intensive” industries. Calabrese said those industries include energy and utilities, manufacturing as well as transportation.

Fifth-generation wireless vendors are focusing on new applications such as private wireless networks in factories that are the networking equivalent of private clouds. Nokia has about 1,300 customers, and it is expanding its 5G offerings to enabling private networks that support IoT deployments like Industry 4.0.

“We see the growth that’s coming around private wireless, we’re going to expand our ecosystem of partners, we’re going to expand how we work with [5G] alliances,” Calabrese said during a virtual IoT event on Sept. 17.

While industrial applications are widely seen as driving early IoT deployments, Nokia and other network gear vendors argue that digital transformation efforts for manufacturers and other asset-heavy operations are fundamentally different from other industries. Information industry leaders like Amazon (NASDAQ: AMZN), for example, are able to replace physical assets with digital copies.

“Industry 4.0 will not replace physical with digital [copies],” according to Calabrese. Instead, it will use digital technologies “to control physical assets,” through digital twins—a replica of a physical asset.

“The goal here is to achieve that level of digital control and self-orchestration,” added Calabrese. “In order to do that we need to elevate the reliability, performance and predictability of the network.”

Current general-purpose IT technologies are insufficient for controlling mission-critical applications, Nokia argues. Hence, they are promoting 5G-driven private wireless networks as operations and IT infrastructure converge on factory floors.

As for edge computing,” Calabrese added, “You have to be able to position that compute where it needs to be,” either at the edge, near edge or in a public or private cloud.

Related

George Leopold has written about science and technology for more than 30 years, focusing on electronics and aerospace technology. He previously served as executive editor of Electronic Engineering Times. Leopold is the author of "Calculated Risk: The Supersonic Life and Times of Gus Grissom" (Purdue University Press, 2016).