Hyperion Research: COVID-19 Changing the Global 2020 HPC Market Landscape

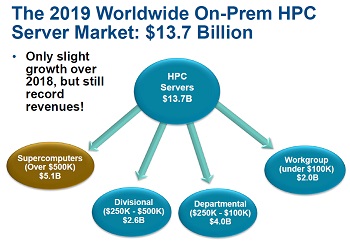

SC20—Before the COVID-19 pandemic essentially stopped the world in its tracks in March, the global HPC server market was expected to grow from $13.7 billion in 2019 to $14.5 billion in 2020, according to estimates from Hyperion Research.

Things since then have certainly changed, with Hyperion’s latest November forecast calling for global HPC server revenue for 2020 of $11.9 billion, a 17.9% decline from its earlier estimate, led by the global business shrinkage due to the devastating pandemic. Hyperion Research unveiled its latest “SC20 HPC Market Results and New Forecasts” report Tuesday (Nov. 17) at the SC20 supercomputing conference, where it traditionally presents its market analyses. SC20 is being held virtually this year due to the pandemic.

The November 2020 forecast is at least up a bit from the company’s July 2020 forecast – the analyst firm's first following the start of the coronavirus pandemic – when HPC server revenue was originally downgraded to $10.9 billion for this year.

HPC server revenue forecasts through 2024 have also been cut by Hyperion compared to its May 2020 figures. The May 2020 forecast originally called for $20.8 billion in HPC server revenue by 2024, for a compound annual growth rate (CAGR) of 8.7%. That was cut in the November update to $19 billion, for a CAGR of 6.8%, according to the company.

“We've been spending the last six to nine months to try to really understand what is the COVID-19 virus impact to the overall HPC market,” Hyperion CEO Earl C. Joseph said in a briefing with the HPC community. “We've done a lot of surveys, and about a quarter ago, we thought the impacts were going to be extremely severe. Now we think that they won't be quite as bad,” depending on the market segment.

The pandemic has delayed product shipments, which impacts the figures, he said. “There are also delayed revenues as far as customers allowing vendors in the door to install systems” as well as customers delaying orders.

Countering some of these losses, however, is some new HPC demand to create systems to combat the virus, said Joseph. “We're also seeing public cloud computing grow quite a bit. In the past with cloud computing … one big advantage was dealing with spikes in your workloads. Very few people thought the spike could be zero. If the government tells you that you have to close your doors for two months, and then on Monday morning you can open the doors again, that value proposition of being able to turn off your expenditures and turn it on immediately has become dramatically more powerful, and hence cloud computing is doing well.”

The biggest negative impacts on HPC server sales are in the low end of the market, where spending cuts are traditionally seen in downturns, said Joseph. “The net for the first half of 2020, we've seen a decline of 11.5% for on-prem server purchases, and we are now forecasting a decline of about 14% for the entire year.”

The 2020 results will be a contrast from 2019 and 2018, which were consecutive record-breaking years of $13.68 and $13.7 billion in HPC server revenue, said Joseph.

The 2020 results will be a contrast from 2019 and 2018, which were consecutive record-breaking years of $13.68 and $13.7 billion in HPC server revenue, said Joseph.

“On the positive side, if one can use those terms [in the pandemic], there is more funding being allocated for the very high end of the market to help combat COVID-19,” he said. “But also we're seeing some regular shifts in the market itself. In perspective, we thought it was going to be six or seven percent growth here. So, you're still talking about a delta of about 20%, which is a very substantial change from the impact.”

Hyperion’s 2020 Cloud Forecast

As the COVID-19 pandemic continues, it is driving more customers to increase spending on cloud computing, which is booming due to work-from-home requirements across the nation and the world, said Hyperion analyst Alex Norton.

The latest Hyperion cloud spending forecast for 2020 points to $4.3 billion in revenue, up from an earlier estimate for the year of $4.26 billion. COVID-19 impacts continue to accelerate cloud adoption, as HPC in the cloud is expected to grow more than 2.5 times faster than the on-prem HPC server market, according to Hyperion. By 2024, the five-year CAGR is expected to reach a 17.6% increase.

In the past, cloud costs were simply seen by customers as actual dollars spent on needed services, but new data suggests that users are looking more closely at the built-in cost-effectiveness of the cloud, said Norton. “And they are incorporating new portions of running a workload to that [thinking]. This includes looking at queue times which can be very long on-prem and are non-existent in the cloud.”

At the same time, cloud options which allow for scaling that may not be possible on-prem, he said. “These are … factors that are now being incorporated into a cost-effectiveness analysis for HPC workloads.”

The report also shows that AI workloads continue to grow in adoption and utilization in the HPC market, said Norton. “Recent data suggests that the average or traditional HPC user is anticipating to run about 20% of their HPC-enabled AI workloads in the cloud in the next year. Part of this increase is due mainly to access to a variety of hardware and software geared towards AI applications, and also access to data that is either stored or collected in the cloud.”

New Trend: HPC Users in 2020 Inquiring About Quantum Computing

One surprise at this year’s Hyperion SC20 presentation came from Hyperion VP of research Bob Sorensen, who said he is seeing more interest in the promise of quantum computing from traditional HPC users. And that increasing interest comes not only from existing HPC users looking for performance gains on critical workloads, optimization, AI and machine learning, but also from traditional enterprise IT shops that never before might have considered themselves as HPC users, he said.

“They understand that quantum computing offers some very interesting performance potential,” said Sorensen. “They're not interested in quantum supremacy, and they're not interested in heretofore intractable solutions. They're interested in performance gains that perhaps may be as little as 40 times to 50 times what they have now. They're looking at that as a competitive advantage.”

Those users are looking for some key applications to experience an acceleration that moves them about four to five years down the road when it comes to computational capability, said Sorensen. “It's not unlike what we saw in the GPU world, narrow application with some very interesting performance that ultimately may start to flip right out. That was the biggest surprise that I saw this year.”

Exascale HPC Highlights for 2020

In the exascale computing realm, progress continues to be made on systems being built and proposed around the world, according to the latest Hyperion Research report.

In the U.S., three systems are scheduled to roll out over the next few years, with a combined budget of about $1.8 billion, said Sorensen. The Aurora system, being built for the U.S. Department of Energy Office of Science at Argonne National Laboratory, was to be the first U.S.-based exascale system but is now delayed by about one year due to delays with the Intel 7nm Ponte Vecchio GPU chips slated for the machine. Instead, the Frontier system that will be installed in Oak Ridge National Lab (delivery in late 2021, acceptance in 2022), will be the first U.S. exascale system, said Sorensen. The third system is the El Capitan (CORAL-2) supercomputer being built for Lawrence Livermore National Lab.

Other nations are also busy on exascale projects, said Sorensen. “China is really trying to flex its capabilities in building not only HPC [machines], but the component technology that drives those HPC [machines], so we're anxiously awaiting what happens to come out of China and these systems,” he said. Systems being built in China include NUDT (Tianhe), Sugon and Sunway, he added.

“Each of these were announced as prototypes a few years back,” said Sorensen. “We're not sure which one of these three will eventually be selected for full-up production. One, two, or perhaps all three may actually see the light of day at some point.”

In Europe, the European Union is looking at lots of interesting diversity and plans for exascale machines, he said. A slate of 150-petaflops to 200-petaflops systems are being built in Finland, Spain and Italy, for a total investment of about $771 million, starting in the fourth quarter of this year. “UK plans are a bit more muddy right now with their exit from the EU,” said Sorensen. “They will not be able to participate fully in the EuroHPC projects, but we do know that they are making some plans to develop a system that they could use for themselves. Cost estimates are between $929 million to $1.6 billion. But the key there is to stand by for some more details as they do roll out.”